Buying a property is one of the biggest financial decisions you’ll make, so it is important to be prepared! If you are ready for the adventure of finding a home, it is time to explore some important home buying tips and advice intended to you help you along the way.

Make Sure You Are Ready To Commit To A Loan

Defining your personal and financial goals is important. Most mortgage loan terms are 15 to 30 years. Even though you may not intend to stay in your home that long, buying a house is still a major commitment.

Start by asking yourself these questions:

Am I ready to commit to this home and city for at least 3 years?

Do I have an emergency fund that can cover at least 3 months of expenses?

Do I have a stable income?

Am I prepared for the ongoing expenses of maintaining a home?

Why Get Pre-Approved?

It can be tempting to jump right into house hunting, but it is a good idea to go through the process of getting a mortgage preapproval prior to viewing properties.

It is important to know the difference between prequalification & preapproval. Let’s review the difference now.

Prequalification letter

This is an estimated amount of the home loan you can secure. It is based on certain assumptions and is not a guaranteed loan offer.

Preapproval letter:

This is an official document with expected loan amount based upon your current financials. It is what the lender is willing to loan you, pending confirmation.

Getting preapproved makes the initial process of finding a home easier. You will know how much home you can afford to help you shop within your budget. It allows you to make a strong offer, showing sellers you have the means to purchase the home. At the end of the day, when you’re preapproved, you are less likely to run into last-minute surprises with your mortgage lender that might affect the purchase.

Understanding Your Loan Options

There are multiple types of mortgage loans available and the type you choose will influence your down payment, the type of home you can buy and more. Here are a few of the most common mortgage loan types.

Conventional loans

These are the most common and are typically used with as little as 3% down for a primary residence. Putting the standard 20% down, can help you avoid private mortgage insurance (PMI) on a conventional loan.

Federal Housing Administration (FHA) loans

It can allow you to pursue the purchase of a property with less strict financial and credit score requirements. This loan can be used with 3.5% down and a credit score as low as 580.

Department of Veterans Affairs (VA) loans

These are exclusive to veterans, active-duty armed forces members, the National Guard, and qualified spouses. With this loan, you can qualify with 0% down.

US Department of Agriculture (USDA) loans

These are for individuals who are looking to purchase in a qualified rural or suburban area. Subject to household income restrictions, USDA loans are typically 0% down.

If you haven’t spoke to a loan officer &

don’t know what type of loan would be best for you, we can help you get connected with someone today.

First Time Home Buyers

If you qualify as a first-time home buyer you can benefit from several assistance programs that help provide down payment assistance loans and grants. You may have access to state programs, tax breaks, and an FHA loan.

According to the U.S. Department of Housing and Urban Development (HUD), a first-time home buyer is any one of the following:

- An individual who’s had no ownership in a principal residence during the 3-year period ending on the date of purchase (This includes a spouse, and if either spouse meets the aforementioned test, they’re considered a first-time home buyer.)

- A single parent who’s only owned a principal residence with a former spouse while married

- An individual who’s a displaced homemaker and has only owned a principal residence with a spouse

- An individual who’s only owned a principal residence not permanently affixed to a permanent foundation in accordance with applicable regulations

- An individual who’s only owned a property that wasn’t in compliance with state, local or model building codes and that can’t be brought into compliance for less than the cost of constructing a permanent structure

Your Credit

Once you have spoken to a loan officer and you’re ready to get preapproved, the lender will pull your credit. It is important to know that this is the time to “shop around.” Talk to multiple loan officers to help get the best rate. Having your credit pulled at multiple times, during this process, doesn’t affect your score, as many believe. However, having your credit pulled “here and there” will influence your credit overtime.

Once you have chosen a lender, this is not the time to open a new line of credit, like a credit card or personal loan. Lenders monitor your credit report. Any new debt incurred, during this time, could affect your final loan approval.

Closing Costs

Don’t assume your downpayment is all you will need come closing day. You will also have closing costs that will need to be paid before purchasing your new home. These are upfront expenses that go to your lender. Some common closing costs you might see are:

- Pest Inspection Fees

- Appraisal Fee

- Attorney Fee

- Escrow Fees

- Title Insurance Expenses

- Homeowners Insurance

- Discount Points

- Prorated Property Taxes

You will see your exact closing costs on a document called a Closing Disclosure. Typically, you will pay 2%-5% of your loan total in closing costs.

As a buyer you will pay for these directly or you can ask the seller to help cover closing costs (seller concessions).

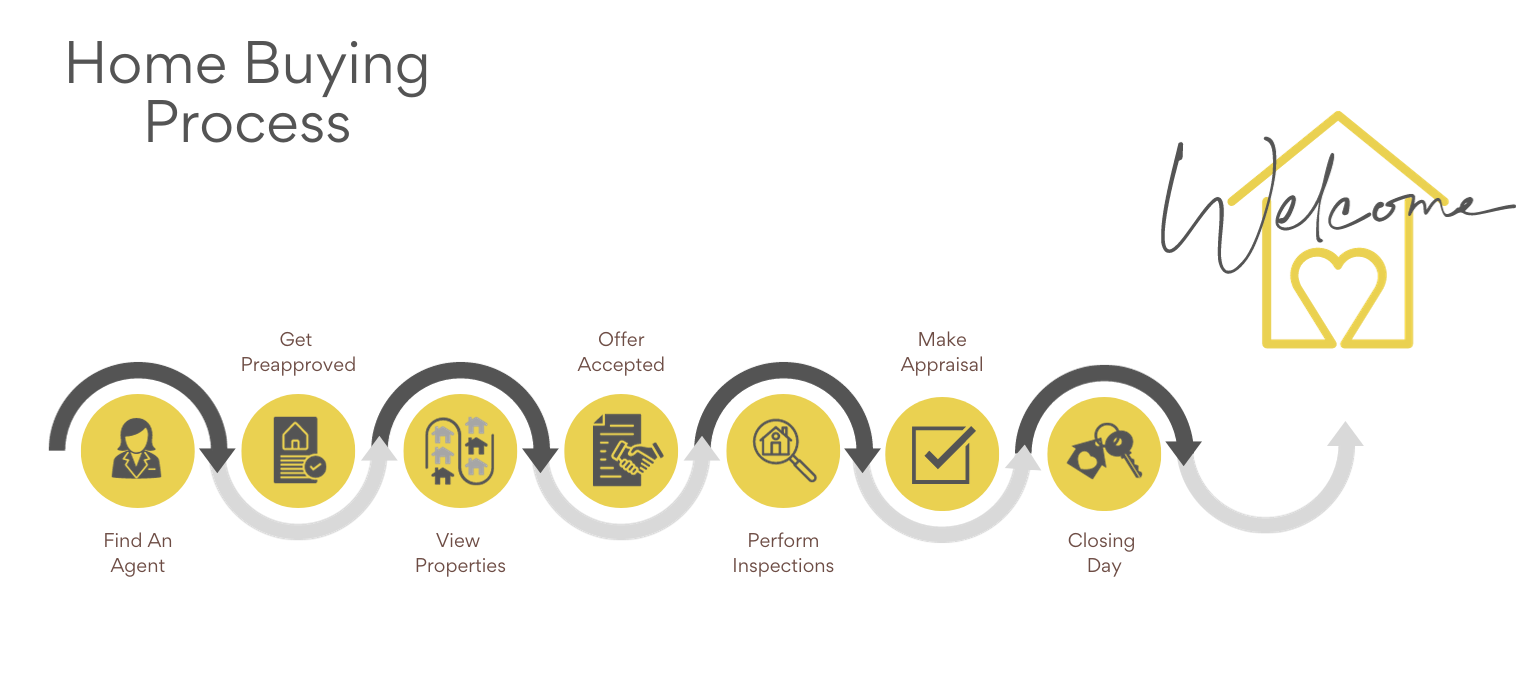

Working With A Real Estate Agent

It can be very helpful to work with a real estate agent, especially as a first-time homebuyer. At Golden Creek Realty, we are local professionals who are experts in the home buying process & your local market. We can help by:

- Pointing you in the right direction in speaking with qualified loan officers

- Showing you properties in your area that fit your needs and price range

- Attending showings with you to learn more about your priorities as a homeowner

- Helping you decide how much to offer for a property

- Submitting an offer letter on your behalf

- Helping you negotiate with the seller’s agent after you submit an offer

- Attending the closing with you to make sure everything is in order with your purchase

Buying a home should be an adventure to enjoy!

With a thought-out strategy and the right help, you can work toward your closing day with ease. Are you ready to have some fun?